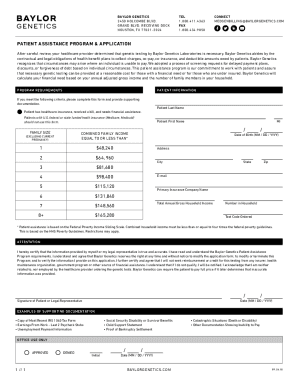

PA REV-72 2017-2026 free printable template

Show details

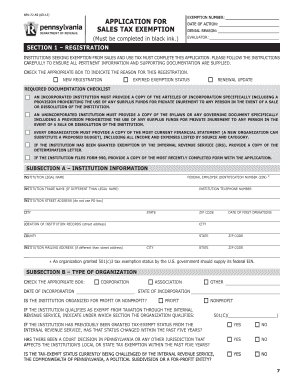

This document is an application for institutions seeking exemption from sales and use tax in Pennsylvania, detailing the necessary steps, required documentation, and information to be submitted by

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign rev 72 form

Edit your rev72 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pa sales tax exemption form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit rev 72 sales tax exemption application online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit pa rev 72 form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA REV-72 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out irs form rev 72

How to fill out PA REV-72

01

Obtain the PA REV-72 form from the Pennsylvania Department of Revenue website.

02

Fill in your personal information, including your name, address, and tax identification number.

03

Provide details about the property for which you are claiming the property tax exemption.

04

Indicate the reason for requesting the exemption by selecting the appropriate box.

05

Attach any required documentation that supports your claim for the exemption.

06

Review the completed form for accuracy and completeness.

07

Submit the PA REV-72 form to your local county assessor's office by the specified deadline.

Who needs PA REV-72?

01

Individuals or organizations seeking property tax exemptions in Pennsylvania.

02

Property owners who qualify for certain tax benefits based on criteria set by the state.

Fill

form rev 72

: Try Risk Free

People Also Ask about rev 72 form

What is a E 595E form?

North Carolina Form E-595E, Streamlined Sales and Use Tax Certificate of Exemption, is to be used for purchases for resale or other exempt purchases.

Who is eligible for sales tax exemption in PA?

Major items exempt from the tax include food (not ready-to-eat); candy and gum; most clothing; textbooks; computer services; pharmaceutical drugs; sales for resale; and residential heating fuels such as oil, electricity, gas, coal and firewood.

What is pa form mv 4ST?

This completed form is attached to the MV-1 or MV-4ST for any transfer for which a gift exemption from Pennsylvania sales tax is claimed. The form may be used for vehicles currently titled in Pennsylvania and for any vehicle given as a gift with an existing out-of-state title.

Does Pennsylvania have tax exemptions?

Some types of income are exempt from Pennsylvania state income tax, including child support, alimony, unemployment payments, and some capital gains on the sale of a primary residence. Some deductions are allowed for contributions to educational savings accounts and medical or health savings accounts.

What items are exempt from PA sales tax?

Major items exempt from the tax include food (not ready-to-eat); candy and gum; most clothing; textbooks; computer services; pharmaceutical drugs; sales for resale; and residential heating fuels such as oil, electricity, gas, coal and firewood. The Pennsylvania sales tax rate is 6 percent.

Are purses tax free in PA?

(1) The sale or use of clothing is not subject to tax. (2) The sale or use of accessories, ornamental wear, formal day or evening apparel, fur articles and sporting goods and sporting clothing shall be subject to tax unless the purchaser is entitled to claim an exemption under the law.

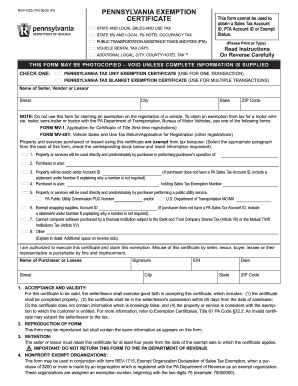

How do I fill out a Pennsylvania exemption certificate?

How to fill out a Pennsylvania Exemption Certificate Enter your Sales Tax Account ID on Line 3. Name of purchaser should be your registered business name. Address of purchaser should be the registered address of your company. Sign, enter your EIN and date the form.

What clothing is tax exempt in Pennsylvania?

Pennsylvania. Pennsylvania tax on clothing tax are fairly generous. The state exempts all clothing sales from sales tax except for formal wear, sporting equipment, and anything made with or in imitation of fur.

What is PA utility sales tax exemption?

Pennsylvania offers an exemption from state and local sales tax on the purchase of electricity, natural gas, and water used in qualifying production activities. This tax exemption is authorized by 61 Pa. Code § 32.32 and 32.25.

How do I look up a PA sales tax license?

To view licenses for sales tax or other tax types: Log in to myPATH. If you have access to more than one client or taxpayer, you must select the Name hyperlink to view correspondence for a specific account. Navigate to the More tab. Select the View Letters link from the Letters panel.

How do I find my PA sales tax exempt number?

To verify your Entity Identification Number, contact the e-Business Center at 717-783-6277.

How do I get a PA sales tax exemption certificate?

HOW TO GET A RESALE CERTIFICATE IN PENNSYLVANIA ✔ STEP 1 : Complete a PA-100 Form (sales tax registration) ✔ STEP 2 : Fill out the Pennsylvania REV-1220 exemption certificate form. ✔ STEP 3 : Present a copy of this certificate to suppliers when you wish to purchase items for resale.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my pa sales tax exemption online directly from Gmail?

pa tax exemption form pdf and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I fill out pa tax exempt renewal form using my mobile device?

Use the pdfFiller mobile app to fill out and sign rev 72 pennsylvania. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

How do I edit pa form rev 72 on an iOS device?

Use the pdfFiller mobile app to create, edit, and share rev 72 application sales tax exemption form from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is PA REV-72?

PA REV-72 is a form used in Pennsylvania for reporting and claiming property tax or rent rebates for eligible individuals, typically senior citizens or those with disabilities.

Who is required to file PA REV-72?

Individuals who are aged 65 or older, or those who are permanently disabled and meet certain income guidelines are required to file PA REV-72 to claim property tax or rent rebates.

How to fill out PA REV-72?

To fill out PA REV-72, individuals need to provide personal information, details about their income, property taxes or rent paid, and any necessary documentation supporting their claim.

What is the purpose of PA REV-72?

The purpose of PA REV-72 is to provide financial assistance to eligible Pennsylvania residents through property tax or rent rebates, thereby reducing their financial burden.

What information must be reported on PA REV-72?

PA REV-72 requires reporting of personal identification details, income levels, property tax or rent paid, and any applicable deductions or credits.

Fill out your PA REV-72 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rev 72 Pa Sales Tax Exemption is not the form you're looking for?Search for another form here.

Keywords relevant to pa rev 72 application

Related to pa sales tax form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.