Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

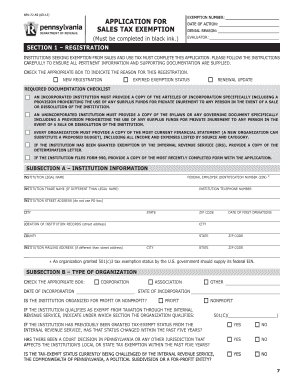

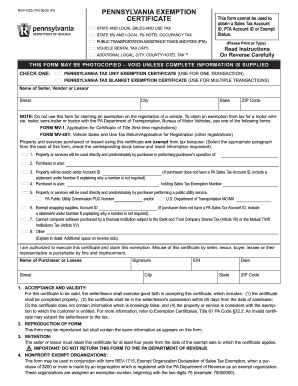

What information must be reported on exemption from pennsylvania sales?

If a business is exempt from Pennsylvania sales tax, they must provide a valid exemption certificate to their vendors. This exemption certificate must include the business name, its Federal Employer Identification Number (FEIN), and the type of exemption being claimed (resale, nonprofit, etc.).

What is exemption from pennsylvania sales?

Exemption from Pennsylvania sales refers to certain transactions or individuals that are not required to pay sales tax in the state of Pennsylvania. Pennsylvania offers various sales tax exemptions for specific goods, services, and organizations. Some common examples of exempt transactions include purchases made by non-profit organizations, government entities, and items like groceries, prescription drugs, and residential heating fuels. Additionally, certain manufacturing equipment, machinery, and raw materials used in production may also be exempt from sales tax in Pennsylvania. It is important to note that specific eligibility criteria and documentation requirements may apply to qualify for these exemptions.

Who is required to file exemption from pennsylvania sales?

In Pennsylvania, certain organizations and entities are eligible for exemption from sales tax. These exemptions are typically granted to non-profit organizations and government agencies. Examples of entities that may be required to file for exemption from Pennsylvania sales tax include:

1. Qualified non-profit organizations: Non-profit organizations that qualify for exemption and engage in activities such as providing charitable, educational, religious, or scientific services may file for sales tax exemption.

2. Government agencies: Federal, state, and local government agencies, including public schools, may be eligible for exemption from sales tax.

3. Hospitals and health care providers: Generally, hospitals and healthcare providers are exempt from sales tax when they provide services that are distinguished from services provided by for-profit entities.

4. Education institutions: Educational institutions, such as colleges, universities, and K-12 schools, may be eligible for sales tax exemption on certain purchases related to their educational mission.

It's important to note that each exemption category may have specific criteria and requirements outlined by the Pennsylvania Department of Revenue. Additionally, exemptions may not apply to all purchases made by the exempt organization. Therefore, it's advisable for organizations to consult with a tax professional or refer to the Pennsylvania Department of Revenue guidelines for specific information regarding eligibility and filing procedures.

How to fill out exemption from pennsylvania sales?

To properly fill out an exemption form for Pennsylvania sales, you need to follow these steps:

1. Obtain the correct form: You need to obtain the Pennsylvania Sales and Use Tax Exemption Certificate (Form REV-1220). This form is available on the official website of the Pennsylvania Department of Revenue or can be obtained from their local office.

2. Provide basic information: At the top of the form, enter your business name, address, and federal employer identification number (FEIN). If you are an individual, provide your name and Social Security number instead of a business name and FEIN.

3. Select the applicable exemption reason: Indicate the reason for exempting the transaction from sales tax by checking the appropriate box under "Exemption Reason." Some common exemption reasons include resale, manufacturing, agricultural production, or government entity, among others.

4. Provide additional details: If the selected exemption reason requires further information, fill out the additional details section on the form. For example, if you selected "Resale," you will need to provide the name of the supplier, address, and your account number with the supplier.

5. Sign and date the form: Sign and date the form at the bottom. If you are signing on behalf of a business, indicate your title or authority to sign. By signing, you are certifying the accuracy of the information provided.

6. Give the form to the seller: Provide the completed and signed form to the seller when making a tax-exempt purchase. The seller may retain a copy for their records.

Remember to keep a copy of the completed form for your own records as well.

Please note that this is a general guide, and it's always best to consult the Pennsylvania Department of Revenue or a tax professional for specific instructions or any updates in the exemption process.

What is the purpose of exemption from pennsylvania sales?

The purpose of exemption from Pennsylvania sales tax is to provide relief or special treatment to certain types of transactions or entities. It allows for the exclusion or waiver of sales tax on specific goods, services, or organizations as deemed appropriate by the Pennsylvania government.

Some common reasons for exemption from Pennsylvania sales tax may include:

1. Non-profit organizations: Non-profit entities such as charitable, educational, religious, or government organizations may be exempt from paying sales tax on certain purchases, as they are deemed to provide public benefits.

2. Resale exemption: Businesses that purchase goods for the purpose of reselling them and collecting sales tax from their customers are exempt from paying sales tax on those items at the time of purchase. The sales tax is then collected when the items are sold to the end consumer.

3. Manufacturing or agricultural exemptions: Certain materials, machinery, or equipment used in the manufacturing or agricultural processes may be exempt from sales tax as the government aims to support these industries due to their contribution to the economy.

4. State and local government agencies: Sales tax exemptions may apply to purchases made by government agencies to facilitate their operations and services.

5. Medical necessities: Some medical equipment, devices, and supplies may be exempt from sales tax to ensure their affordability and accessibility for individuals with healthcare needs.

It is important to note that the specific details and requirements for sales tax exemption in Pennsylvania may vary depending on the category or purpose of exemption.

What is the penalty for the late filing of exemption from pennsylvania sales?

The penalty for the late filing of an exemption from Pennsylvania sales tax varies depending on the circumstances. Generally, if a taxpayer fails to file an exemption certificate within the required time frame, they may be subject to penalties and interest on any tax that should have been paid. These penalties and interest can accumulate over time until the exemption certificate is filed and the taxes are paid. It is recommended to contact the Pennsylvania Department of Revenue or a tax professional for specific information regarding penalties and any applicable deadlines.

How can I manage my rev 72 directly from Gmail?

pennsylvania sales tax exemption nonprofit form and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I fill out pa tax exemption form using my mobile device?

Use the pdfFiller mobile app to fill out and sign rev 72 form. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

How do I edit pa sales tax exemption form on an iOS device?

Use the pdfFiller mobile app to create, edit, and share form rev 72 from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.